Will Social Security Be Paid In October 2025. That's down from the 3.2% increase for. Social security benefits and supplemental security income (ssi) payments for more than 72.5 million americans will increase 2.5% in 2025, the social security.

Social security’s full retirement age (fra) will increase next year. And in 2025, a number of key changes are likely to arrive that could impact retirees and workers alike.

Social Security COLA 2023 How much will recipients get next year, Social security needs to be able to adjust for inflation in several regards.

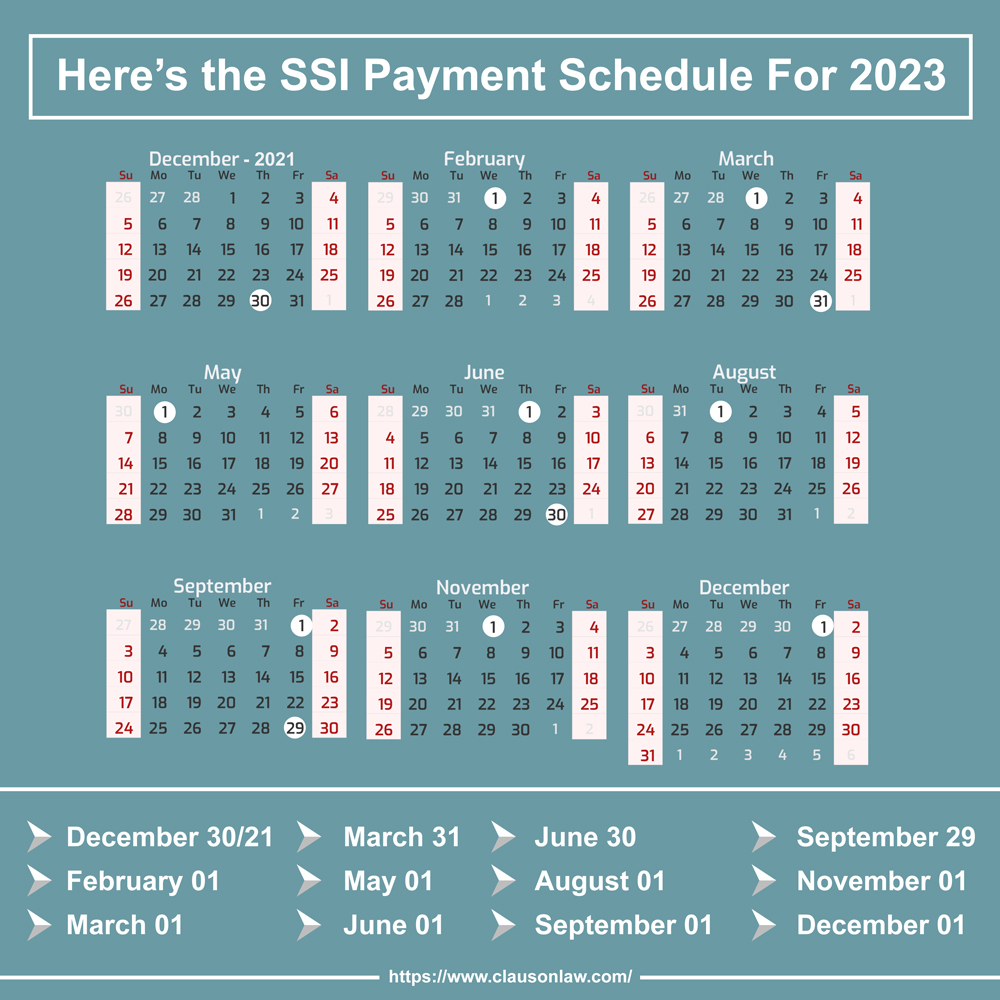

Ssi Check Schedule 2025 Rivy Vinita, Federal law states that social security benefits (and all other federal benefits) must be paid electronically through direct deposit to your bank account or onto a direct express.

Will Social Security Be Paid In June 2025 Sandi Cordelie, Federal law states that social security benefits (and all other federal benefits) must be paid electronically through direct deposit to your bank account or onto a direct express.

When Will Social Security Benefits Increase In 2025 Phebe Brittani, Aside from the cola and the increased earnings test limits, the maximum benefit will also be increasing.

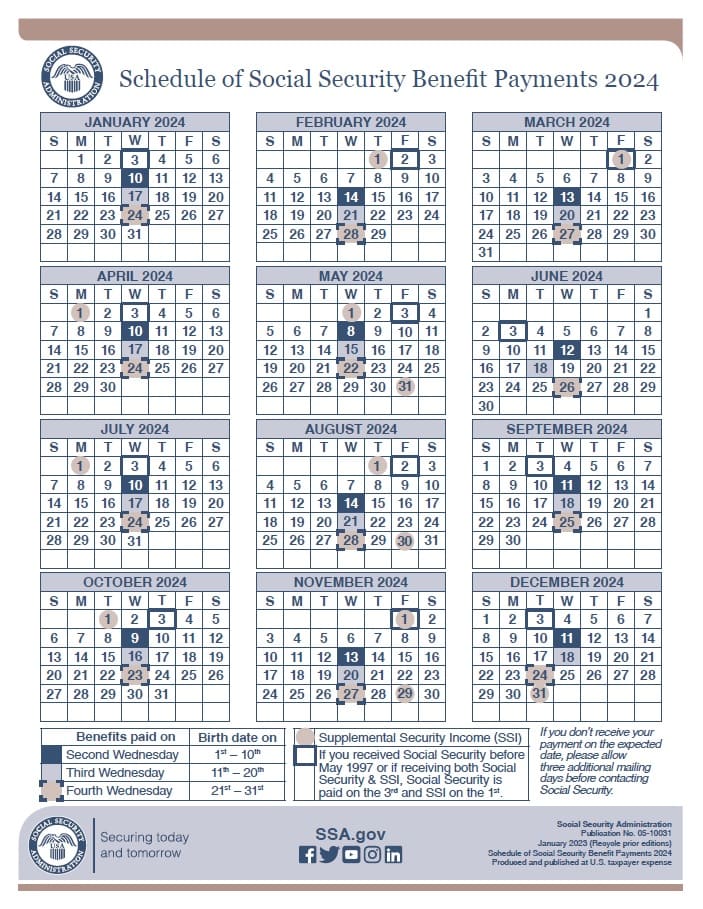

Social Security (SSI & SSDI) Benefit Payments Schedule 2025, 2023, See when you can expect your benefits to arrive and learn more about important 2025 social.

Exact dates Social Security, SSI and SSDI are paid each month in 2022, Certain retirees under fra will have.

New Payments with Lots of Extra Money Announced by Social Security for, The ssa has released this calendar showing the dates of social security payments in 2025.

Will Social Security run out? Retirement News Daily, Aside from the cola and the increased earnings test limits, the maximum benefit will also be increasing.

Latest News! Stimulus Check Social Security News, Will Social Security, Schedule of social security payments ssa publication no.

Social Security benefits in 2025 Here are 4 major changes you need to, On october 10 th, the social security administration announced that the annual cost of living adjustment (cola) for benefits paid and wages subject to payroll taxes will.